Photo of a display board; from contractor Lee Institute, Chrystal Joy, top right, and Toni Tupponce.

May 2, 2023

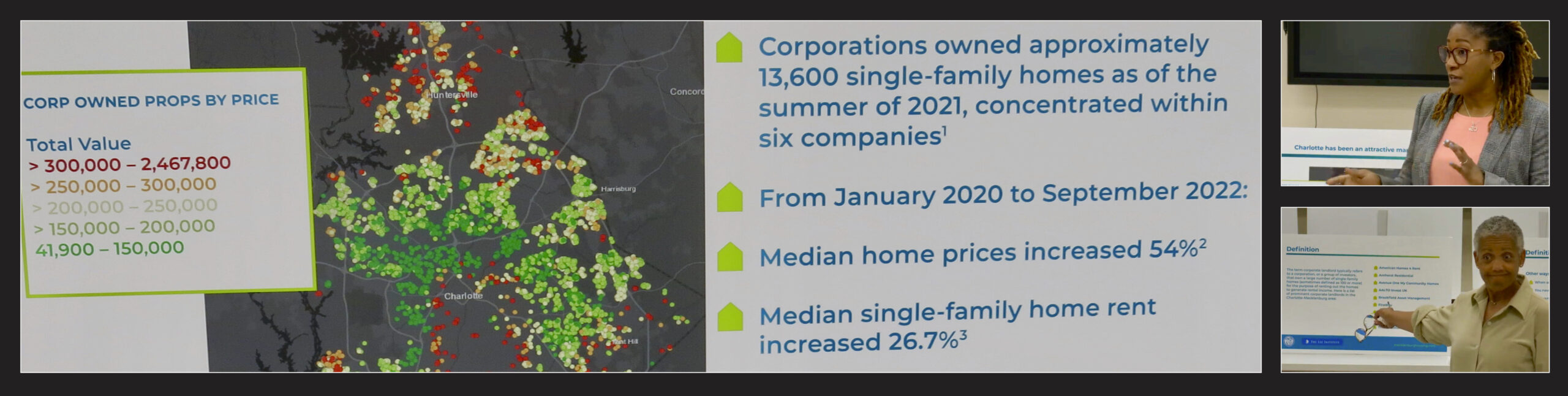

A relatively small number of big corporate investors own thousands of Mecklenburg single-family homes. Complaints about that recent development go beyond communication barriers with out-of-town landlords about deferred maintenance.

At this morning’s Forum, participants voiced a catalog of impacts:

– First-time homebuyers are losing the opportunity to build equity over time. They remain in rent as investors buy up starter homes and then rent them.

– Neighborhoods are losing their sense of community as short-term renters replace long-term buyers.

– And rents throughout the community have risen as corporate owners jack up rents that the participants said many long-term Charlotte residents could not afford.

A few solutions were discussed. Neighborhoods that do not have a homeowners association could create one and then, through that legal framework, impose a maximum rental rate on owners, whether they are individuals who are renting the house where they once lived or are corporate entities with many properties to rent. One participant said covenants written into land deeds in older neighborhoods may prove useful.

Commissioners may be exploring ways they might intervene despite a thicket of legal barriers. There were no commissioners attending in person this morning. But folks on ground – real estate agents and neighborhood leaders – were more focused on organizing collective resident action: informing residents of their rights, organizing, and encouraging young people to step up to buy the homes they grew up in so the equity built up over time and into the future will not leave the family.

There were a few comments that individual communities in other states have taken effective action to discourage out-of-town investors. Forum facilitator Laura McClettie said the county should be enticing out-of-town Black investors to come to Charlotte to help struggling Black neighborhoods survive this latest threat.

The listening tour that began in April is about to close.

A county web page lists two one-hour virtual meetings later this week. There is also an online survey available. And on Thursday at 6:30 p.m. there is an open house on the subject at the Goodwill Opportunity Campus, 5301 Wilkinson Boulevard Room 2347. Register here.

A county announcement said commissioiners were expecting a report this summer.

In their April 6 notice about the listening tour, Mecklenburg staff wrote:

“In recent years, large institutional investors have increased their purchases of single-family homes for the purposes of converting them into rental properties. The Charlotte-Mecklenburg region consistently ranks at the top of these “corporate” home purchases: many neighborhoods have seen swaths of homes purchased by such investors. In the summer of 2021, corporations owned more than 13,000 single-family homes, concentrated within six companies.

“During the pandemic, the median single-family rental price increased nearly 27% in the region, intensifying affordable housing concerns in Charlotte-Mecklenburg. Plus, institutional purchases of single-family homes are typically cash purchases, often curbing homeownership by local buyers who likely require a mortgage.”

The notice did not say what if anything commissioners thought they could do about the situation. And at the Forum, Toni Tupponce from the Lee Institute did not speculate, only vowing that commissioners’ response to the report about the listening tour would be relayed back to the Forum.

Gina Esquivel, who had been scheduled to make this morning’s presentation, was involved in a traffic accident on the way to the Forum and did not attend. She was reported as OK.

Chrystal Joy brought in a number of display boards and passed some of them around at the beginning of the Forum. She said the material was available in PDF form. If it arrives, it will be linked to here.

Tupponce reported that both video and audio from the session would be helpful as staff works on their report to the county. The video is below. A 58 MB audio MP3 file of the session is available here.